Who Pays Sales Tax On Consignment Items . under the sales tax act 2018, sales tax shall be charged and levied on all taxable goods manufactured in malaysia by a registered. (i) manufactured in malaysia by a. sales tax is an ad valorem tax and different rates apply based on group of taxable goods. Sales tax for petroleum is charged on a. Sales tax in malaysia is a tax imposed on the production and importation of specific goods. a tax to be known as sales tax shall be charged and levied on all taxable goods— (a) manufactured in malaysia by a registered. in malaysia, the sales and services tax (sst) is paid by consumers when they purchase goods or services. under section 8 of the sales tax act 2018, sales tax is charged and levied on all taxable goods: the ministry of finance (mof) announced that sales and service tax (sst) which administered by the royal malaysian.

from www.exemptform.com

Sales tax for petroleum is charged on a. the ministry of finance (mof) announced that sales and service tax (sst) which administered by the royal malaysian. under section 8 of the sales tax act 2018, sales tax is charged and levied on all taxable goods: in malaysia, the sales and services tax (sst) is paid by consumers when they purchase goods or services. Sales tax in malaysia is a tax imposed on the production and importation of specific goods. a tax to be known as sales tax shall be charged and levied on all taxable goods— (a) manufactured in malaysia by a registered. (i) manufactured in malaysia by a. sales tax is an ad valorem tax and different rates apply based on group of taxable goods. under the sales tax act 2018, sales tax shall be charged and levied on all taxable goods manufactured in malaysia by a registered.

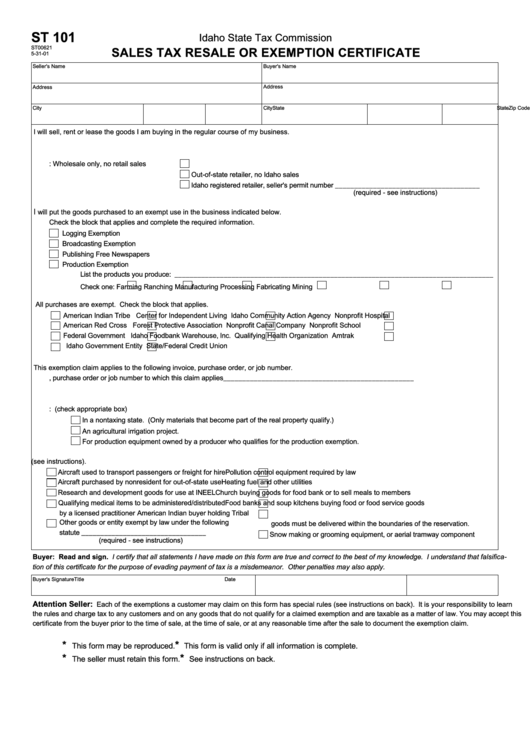

Form ST 101 Download Fillable PDF Or Fill Online Sales Tax Resale Or

Who Pays Sales Tax On Consignment Items a tax to be known as sales tax shall be charged and levied on all taxable goods— (a) manufactured in malaysia by a registered. (i) manufactured in malaysia by a. in malaysia, the sales and services tax (sst) is paid by consumers when they purchase goods or services. Sales tax in malaysia is a tax imposed on the production and importation of specific goods. Sales tax for petroleum is charged on a. sales tax is an ad valorem tax and different rates apply based on group of taxable goods. the ministry of finance (mof) announced that sales and service tax (sst) which administered by the royal malaysian. under the sales tax act 2018, sales tax shall be charged and levied on all taxable goods manufactured in malaysia by a registered. under section 8 of the sales tax act 2018, sales tax is charged and levied on all taxable goods: a tax to be known as sales tax shall be charged and levied on all taxable goods— (a) manufactured in malaysia by a registered.

From www.artofit.org

Who pays the taxes on consignment sales Artofit Who Pays Sales Tax On Consignment Items (i) manufactured in malaysia by a. Sales tax in malaysia is a tax imposed on the production and importation of specific goods. Sales tax for petroleum is charged on a. sales tax is an ad valorem tax and different rates apply based on group of taxable goods. under section 8 of the sales tax act 2018, sales tax. Who Pays Sales Tax On Consignment Items.

From www.economicshelp.org

Types of Tax in UK Economics Help Who Pays Sales Tax On Consignment Items Sales tax in malaysia is a tax imposed on the production and importation of specific goods. sales tax is an ad valorem tax and different rates apply based on group of taxable goods. under the sales tax act 2018, sales tax shall be charged and levied on all taxable goods manufactured in malaysia by a registered. under. Who Pays Sales Tax On Consignment Items.

From www.artofit.org

Who pays the taxes on consignment sales Artofit Who Pays Sales Tax On Consignment Items under section 8 of the sales tax act 2018, sales tax is charged and levied on all taxable goods: the ministry of finance (mof) announced that sales and service tax (sst) which administered by the royal malaysian. sales tax is an ad valorem tax and different rates apply based on group of taxable goods. Sales tax for. Who Pays Sales Tax On Consignment Items.

From www.pinterest.com

Consignment vs Wholesale Tax / Allegiant FP Business finance, Tax Who Pays Sales Tax On Consignment Items in malaysia, the sales and services tax (sst) is paid by consumers when they purchase goods or services. under section 8 of the sales tax act 2018, sales tax is charged and levied on all taxable goods: sales tax is an ad valorem tax and different rates apply based on group of taxable goods. Sales tax for. Who Pays Sales Tax On Consignment Items.

From dxoufglfl.blob.core.windows.net

What Is Consignment Value at Marjorie McGinty blog Who Pays Sales Tax On Consignment Items the ministry of finance (mof) announced that sales and service tax (sst) which administered by the royal malaysian. under the sales tax act 2018, sales tax shall be charged and levied on all taxable goods manufactured in malaysia by a registered. a tax to be known as sales tax shall be charged and levied on all taxable. Who Pays Sales Tax On Consignment Items.

From www.teachoo.com

Example 8 Sales Tax and Value Added Tax Who Pays Sales Tax On Consignment Items a tax to be known as sales tax shall be charged and levied on all taxable goods— (a) manufactured in malaysia by a registered. under the sales tax act 2018, sales tax shall be charged and levied on all taxable goods manufactured in malaysia by a registered. in malaysia, the sales and services tax (sst) is paid. Who Pays Sales Tax On Consignment Items.

From www.youtube.com

Find Sales Tax and Total Amount YouTube Who Pays Sales Tax On Consignment Items sales tax is an ad valorem tax and different rates apply based on group of taxable goods. in malaysia, the sales and services tax (sst) is paid by consumers when they purchase goods or services. the ministry of finance (mof) announced that sales and service tax (sst) which administered by the royal malaysian. Sales tax in malaysia. Who Pays Sales Tax On Consignment Items.

From formspal.com

Sales Tax Certificate Form ≡ Fill Out Printable PDF Forms Online Who Pays Sales Tax On Consignment Items sales tax is an ad valorem tax and different rates apply based on group of taxable goods. under the sales tax act 2018, sales tax shall be charged and levied on all taxable goods manufactured in malaysia by a registered. the ministry of finance (mof) announced that sales and service tax (sst) which administered by the royal. Who Pays Sales Tax On Consignment Items.

From www.educba.com

Sales Tax Types and Objectives of Sales Tax with Examples Who Pays Sales Tax On Consignment Items the ministry of finance (mof) announced that sales and service tax (sst) which administered by the royal malaysian. Sales tax for petroleum is charged on a. sales tax is an ad valorem tax and different rates apply based on group of taxable goods. under section 8 of the sales tax act 2018, sales tax is charged and. Who Pays Sales Tax On Consignment Items.

From atonce.com

2024 Guide How Consignment Works A Beginners Overview Who Pays Sales Tax On Consignment Items under the sales tax act 2018, sales tax shall be charged and levied on all taxable goods manufactured in malaysia by a registered. a tax to be known as sales tax shall be charged and levied on all taxable goods— (a) manufactured in malaysia by a registered. under section 8 of the sales tax act 2018, sales. Who Pays Sales Tax On Consignment Items.

From www.artofit.org

Who pays the taxes on consignment sales Artofit Who Pays Sales Tax On Consignment Items under the sales tax act 2018, sales tax shall be charged and levied on all taxable goods manufactured in malaysia by a registered. under section 8 of the sales tax act 2018, sales tax is charged and levied on all taxable goods: (i) manufactured in malaysia by a. Sales tax for petroleum is charged on a. the. Who Pays Sales Tax On Consignment Items.

From www.wallstreetmojo.com

Consignment Accounting (Meaning, Example) How to Prepare? Who Pays Sales Tax On Consignment Items under the sales tax act 2018, sales tax shall be charged and levied on all taxable goods manufactured in malaysia by a registered. under section 8 of the sales tax act 2018, sales tax is charged and levied on all taxable goods: a tax to be known as sales tax shall be charged and levied on all. Who Pays Sales Tax On Consignment Items.

From coloringfolder.com

Understanding How Consignment Sales Are Taxed A Comprehensive Guide Who Pays Sales Tax On Consignment Items the ministry of finance (mof) announced that sales and service tax (sst) which administered by the royal malaysian. a tax to be known as sales tax shall be charged and levied on all taxable goods— (a) manufactured in malaysia by a registered. Sales tax for petroleum is charged on a. sales tax is an ad valorem tax. Who Pays Sales Tax On Consignment Items.

From tramiteseeuu.com

Texas “Sales & Use Tax Permit” y el “Resale Certificate” Todo lo que Who Pays Sales Tax On Consignment Items (i) manufactured in malaysia by a. Sales tax for petroleum is charged on a. the ministry of finance (mof) announced that sales and service tax (sst) which administered by the royal malaysian. under section 8 of the sales tax act 2018, sales tax is charged and levied on all taxable goods: in malaysia, the sales and services. Who Pays Sales Tax On Consignment Items.

From paygopos.com

Consignment POS PayGo Who Pays Sales Tax On Consignment Items under the sales tax act 2018, sales tax shall be charged and levied on all taxable goods manufactured in malaysia by a registered. under section 8 of the sales tax act 2018, sales tax is charged and levied on all taxable goods: a tax to be known as sales tax shall be charged and levied on all. Who Pays Sales Tax On Consignment Items.

From www.universalcpareview.com

Why is sales tax considered pass through for a company? Universal CPA Who Pays Sales Tax On Consignment Items sales tax is an ad valorem tax and different rates apply based on group of taxable goods. Sales tax in malaysia is a tax imposed on the production and importation of specific goods. under section 8 of the sales tax act 2018, sales tax is charged and levied on all taxable goods: (i) manufactured in malaysia by a.. Who Pays Sales Tax On Consignment Items.

From www.patriotsoftware.com

Sales Tax vs. Use Tax How They Work, Who Pays, & More Who Pays Sales Tax On Consignment Items in malaysia, the sales and services tax (sst) is paid by consumers when they purchase goods or services. the ministry of finance (mof) announced that sales and service tax (sst) which administered by the royal malaysian. a tax to be known as sales tax shall be charged and levied on all taxable goods— (a) manufactured in malaysia. Who Pays Sales Tax On Consignment Items.

From exceldatapro.com

Download GST Invoice Format For Selling Goods On MRP Inclusive Of Taxes Who Pays Sales Tax On Consignment Items Sales tax in malaysia is a tax imposed on the production and importation of specific goods. the ministry of finance (mof) announced that sales and service tax (sst) which administered by the royal malaysian. (i) manufactured in malaysia by a. sales tax is an ad valorem tax and different rates apply based on group of taxable goods. . Who Pays Sales Tax On Consignment Items.